A look into the GTM strategy of 26 AI Agents

Agents of Insights: a weekly newsletter of AI Agents and GTM insights

Hi, and welcome to Agents of Insight, a weekly newsletter about AI Agents and GTM insights.

In this issue, we’ll cover GTM strategies for GTM AI Agents:

The Fit-for-Purpose era of the AI Agents

AI Agent’s Market Positioning: Agent Workforce vs. Agentic Orchestration

Looking around the corner for GTM Leaders: Strategy & Organization decisions

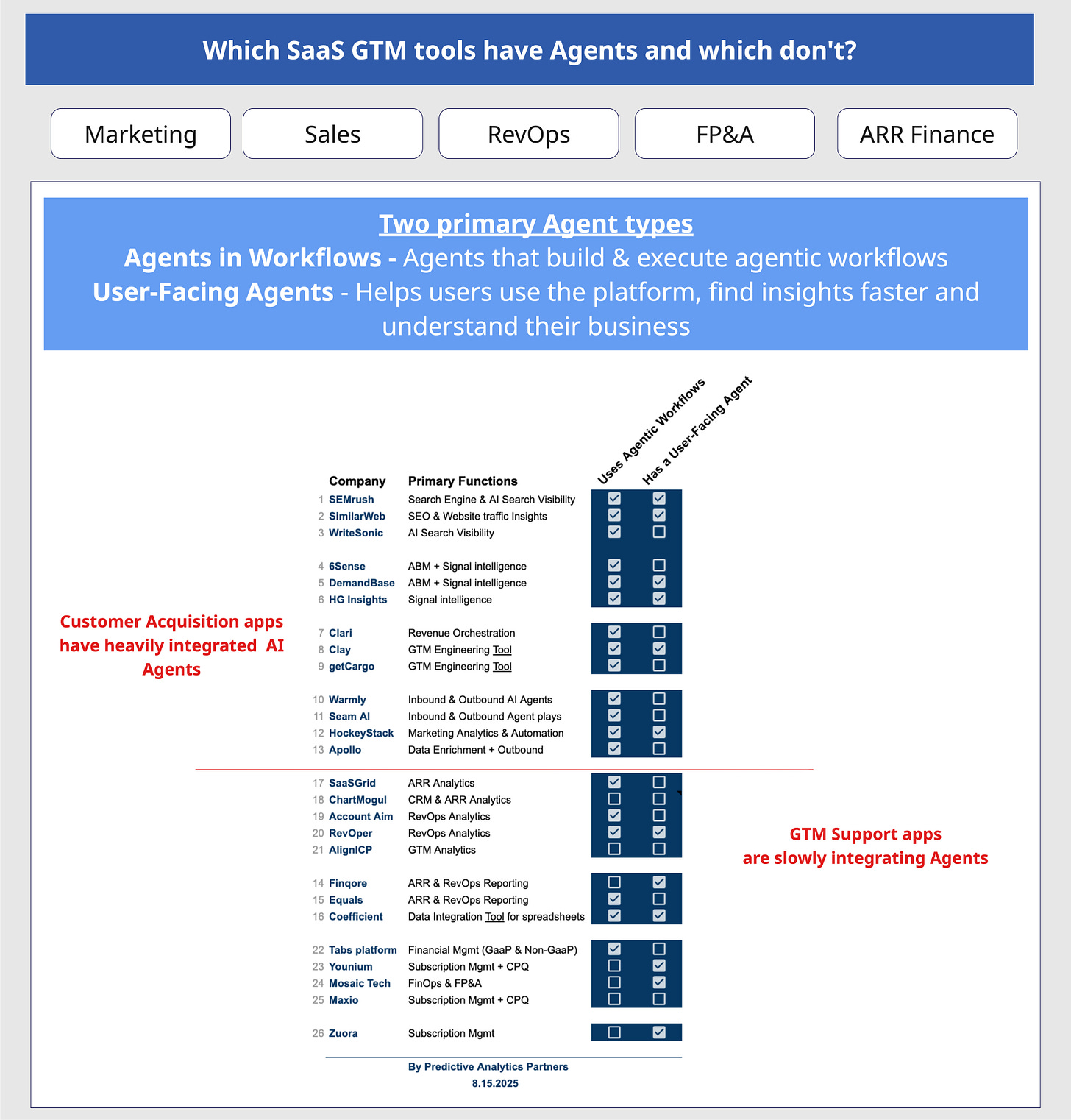

List of 26 GTM applications and their current Agent offerings

This newsletter provides the commercial takeaways behind my LinkedIn Post: A review of 26 GTM AI Agents.

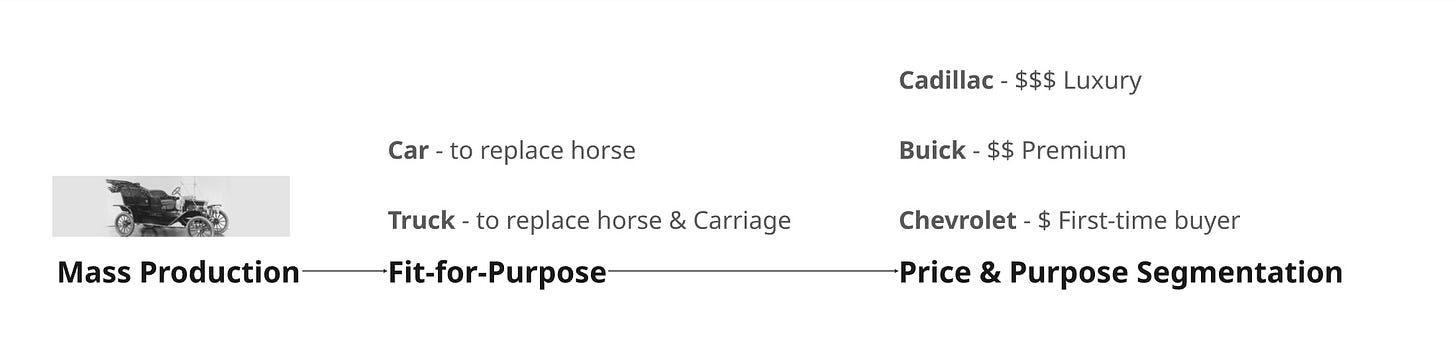

The fit-for-purpose era of AI Agents:

Henry Ford’s mass production of the Model T, which started in 1908, drove (pun intended) the mass adoption of automobiles worldwide. However, the modern automobile market wasn’t established till Alfred Sloan of GMC decided to build “a car for every purse and purpose,” which segmented the market into “Luxury” (Cadillac), “Premium” (Buick), and the “First-Time Buyers” (Chevy). This segmentation brought structure to the market, which brought clarity to the buyer in terms of price, purpose, and quality.

Before GMC brought order to the market with its “price ladder” segmentation in the 1920s, the auto industry was still experimenting with fit-for-purpose design. Ford’s release of the Model TT in 1917 — its first truck — created a natural split: cars for getting around, trucks for getting things done. It was the first time buyers faced a real choice based on what the buyer was solving for, replacing a horse or replacing a horse & carriage.

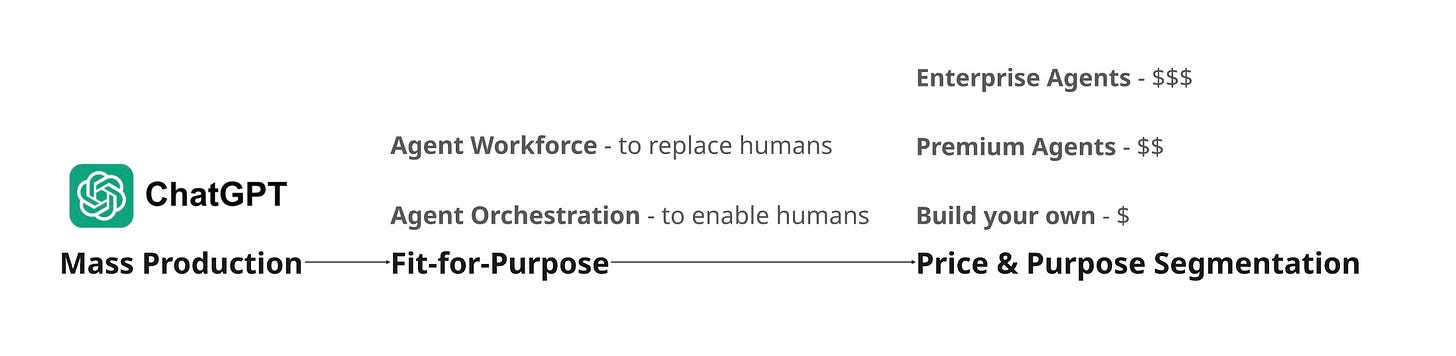

The AI Agent market hasn’t reached a price level of segmentation yet, as B2B buyers are still figuring out how to use and integrate AI Agents into their operations.

Just as the automobile accelerated the adoption of the internal combustion engine, AI Agents will be the vehicle driving generative AI adoption. And like cars, agents are starting to find clear, fit-for-purpose roles in the market.

Broadly, there are two value propositions emerging:

Replacing humans — providing a low-cost alternative to manual work

Enabling humans — making people more effective through better system integration

You’ve probably seen different terms floating around to describe these roles:

Pilot & CoPilot

Autonomous Agent & Agentic Workflows

But in my review of 25+ leading GTM SaaS applications, I kept seeing marketing language over and over again for “Agent Workforce” and “Agent Orchestration.”

Value-Prop Positioning of GTM AI Agents

Across the GTM SaaS ecosystem, companies are carving out two distinct positions:

Agent Workforce → agents that act as a low-cost alternative to humans

Agent Orchestration → agents that connect workflows and systems to amplify human output

Next, I’ll break down how the two positions’ pricing, packaging, and GTM Motions — and what that means for how this market is evolving.

The “Agent Workforce” Go-To-Market strategy

These AI agents are designed to perform the tasks of an employee or a team of employees. Companies deploying or utilizing an Agent Workforce follow the job-to-be-done (JTBD) framework, focusing on existing company jobs, but as work evolves in this AI-enabled world, new jobs to be done will emerge.

Agent Workforce examples:

AI Copy-Writers producing blogs, social posts, or campaign copy - replacing marketing copy writers

AI BDR Agents running outbound sequences and scheduling - replacing BDRs.

AI SDR Agents servicing inbound leads - replacing SDRs

Pricing & Packaging:

Agent Workforce agents are often packaged as an Add-on to an existing platform subscription or as a pure-play agent offering where the company sells only agents.

note: Pricing data was pulled from 1) company pricing pages (linked in the packaging section of the article) or 2) Google’s AI overview search functionality

Packaging:

Platform add-on AI Agents: Semrush, Similarweb, Apollo.io, Outreach.io

Pureplay Agent offering: Warmly, Writesonic

Pricing:

Platform add-ons: $600 - $4,000 Annually

Pureplay Agent offering:

Copy-writers agents: $500 - $5,000 Annually

AI SDRs, AI BDRS: Fixed Price $10K - $48K per year

based on Warmly.ai

Before I get into how these Workforce Agents sell to their target buyers, we need to define some terms first:

PLG: Self-Serve Product-Led Growth (PLG) - Users can purchase from a pricing page without contacting sales

SLG: Direct Sales-Led Growth (SLG) - Sales reps reach out to prospects and interested leads to sell their product at certain prices, as pricing is not shared publicly

Enterprise: Enterprise sales approach - enterprise sales reps sell high-dollar products to a committee of decision makers

GTM Motions: the “how” products or services are sold to target buyers

Platform add-ons: (PLG) + SLG + Enterprise

Pureplay Agent offering: PLG + SLG

The value prop of an Agent Workforce is clear: Cost savings and efficiency:

A Sales team (AI BDR, AI SDR, AI Data Agent) from Warmly costs $48,000 annually

A typical B2B SaaS Sales Rep’s On Target Earnings (OTE) is $360,000 for just one rep.

That’s a $312,000 difference. But what do you do when the Agent keeps missing quota? The market hasn’t yet figured out autonomous agent performance reviews. Additionally, most companies selling agents don’t let you put them through an interview case study.

Analogy:

Just like offshoring brought cost savings and headcount reduction, it also required an offshoring contracts manager and an overseas country manager to supervise the offshore team.

Managing an AI workforce will require an AI spend management process and an AI workforce manager, so the potential $312,000 in savings will be less as you hire people to oversee the agents.

The “Agentic Orchestration” GTM Strategy

This approach puts humans in the loop or in charge, orchestrating multiple agentic workflows to scale GTM operations without fully replacing human decision-making.

Agentic orchestration is primarily stringing together agentic workflows (multi-step tasks) cross-functionally.

Example:

Account-based marketing orchestration

A prospecting workflow will present a prospect list for a human to review

Upon review, a human will initiate a market signals workflow to monitor for buying signals (website visits, social engagement, product research) from the prospect

A human is involved in this step to ensure appropriate AI credit usage to manage spend

Human BDRs or an AI BDR are notified and begin reaching out to the prospects with curated messaging based on buyer signals.

Pricing & Packaging:

Agentic orchestrations are often packaged within a platform as a button or a visual workflow of nodes that execute various features or tasks across the platform. See the account-based marketing orchestration example above.

Another way agent orchestration is packaged is as a stand-alone tool, which is commonly referred to as a Go-To-Market Engineering tool. A GTM Engineer - user of the tool - will connect workflow automations across multiple products or tools to automate a GTM process.

A third way agent orchestration is being packaged is as a Playbook orchestration tool. Playbook orchestration tools differ from GTM Engineering tools as the workflow is already built for you for specific plays, and all a user has to do is provide access to the connected systems (CRMs, Socials, Marketing tool, Slack/Teams).

Packaging:

Platform orchestration: 6sense, Clari agents work across their platform offerings

Tool orchestration (GTM Engineering): Clay and Cargo are tools for GTM Engineers to build multi-step agentic workflow automations

Playbook orchestration: Seam AI provides prebuilt automated marketing and sales plays that don’t require a GTM Engineer to set up and run

Pricing:

Platform orchestration: Multi-year contracts with a median Annual Contract Value (ACV) of around $50K

Tool orchestration (GTM Engineering): Subscription + Usage-based pricing.

Usage-based pricing is based on AI credits, which have different monetary value (1 credit ranges from less than a penny up to $2) based on the product and feature you use. GTM engineering workflows, which often run daily or weekly, range from 10 credits to 100s of credits for the most complex workflows.

Playbook orchestration: Fixed Price $12K - $36K per year

1/10 of a GTM Engineer or GTM Engineering team

GTM Motions:

Platform orchestration: SLG + Enterprise

Tool orchestration (GTM Engineering): PLG + Developer Relations

Developer relations is a GTM motion that qualifies the technical skillset of prospects and provides free usage up to a limit to help the developer test and use the product. Additionally, access is granted to a developer of the product or the developer documentation.

Playbook orchestration: PLG + SLG

Value Prop:

Agents here act as highly capable collaborators rather than autonomous replacements. Humans provide intent and oversight, while agents automate repetitive steps within complex workflows, saving users from painful project management meetings to connect systems or tools.

These platforms are enabling companies to build custom GTM agent plays that align with their internal playbooks and, more importantly, extend their playbooks.

ICPs for Agentic Orchestration:

Platform orchestration: At-Scale companies $100M+ that are looking to mature from a “franken-stack” approach to a seamless platform

Tool orchestration (GTM Engineering): Companies hiring for GTM Engineers

Playbook orchestration: Scale-up companies $10M - $100M or companies looking to dip their proverbial toe in the water before jumping into integrating agents into their operations.

The Baseline Expectations Have Increased

As the race for Agent-enabled Software as a Service (SaaS) is underway, it’s clear that consumers’ baseline expectations have increased.

Just like how every car these days has an LCD screen, the majority of the GTM Apps I reviewed have:

Data Enrichment capabilities through Agentic workflows

most explicitly display “AI Enrichment,” a few just say “Enrichment”

Native analytics of the application’s usage and performance metrics

Customer Service AI Agents that answer questions about the platform and provide basic framework or strategy recommendations

Looking around the corner for GTM Leaders

Planning season is upon us. GTM Leaders (CMOs, CROs, CFOs) need to figure out their plan to compete in the agent-led battle to attract and win customers. GTM leaders have two key decisions:

1. Decide on a GTM Agent approach

Customer acquisition and retention are becoming more and more competitive. To compete for awareness, interest, and budget, companies need Agents and an agent strategy framework to incorporate them into their operations.

Agent Workforce approach — deploying a network of autonomous JTBD agents to either replace or supplement their existing workforce.

Agentic Orchestration — retaining control via human-instructed agent workflows

Use an integrated platform - most expensive (license + implementation)

Use tools - Hire a GTM Engineer or GTM Engineering agency to build playbook automations across systems. This is currently the most common approach due to the hype around GTM Engineering.

Deploy agent plays directly - the easiest option, and the least expensive option, as you're not hiring a full-time employee or buying and implementing expensive software. The downside is that the GTM plays (demand gen. from socials, marketing campaign automation, follow-up sequences) are limited to the plays provided by the software company

Hybrid Strategy — combining GTM engineering function with either an agentic workforce or platforms offering agentic orchestration.

potentially the most expensive option in terms of direct and indirect costs

example: purchasing 6Sense, Clay, and hiring a GTM Engineer

2. Decide on where the agent supervisors work

Companies started hiring or assigning AI managers in 2024 into IT departments to help build an AI strategy. In 2025, companies started to hire for GTM Engineers, but no one has a great answer on who the engineer should report to. The current best practice is to have them report to a manager or director who is both technical and commercial.

GTM Engineers who are focused on data enrichment and CRM orchestration should sit in RevOps.

GTM Engineers who are focused on demand gen and lead gen should sit in marketing, while sales automation-focused engineers should sit in sales.

The companies taking an Agent Workforce approach will have to decide where the Agent Workforce supervisors sit. Under Marketing? Sales? RevOps? IT?

Definitely not IT. Agent Supervisors should be forward-deployed AI managers within commercial teams such as Marketing and Sales. Why not RevOps? The agent supervisors need to be as close to the sales and marketing action as possible.

Sales & Marketing teams will be able to identify errors faster and, more importantly, figure out how to work with the agents better, the closer they are to the agent’s puppet master. The faster your sales and marketing teams learn how to work with agents, the better it is for the whole company.

26 GTM Applications and their Agent Capabilities

Below are the companies I reviewed to develop the views provided in this article. They are a snapshot of the current GTM SaaS landscape (Marketing, Sales, RevOps, FP&A, FinOps) to identify who’s embedding AI Agents, and how:

Marketing:

Marketing signals & automation

6sense — Agentic workflows for GTM plays and an agent workforce email agent

HG Insights — Acquired MadKudu to power intelligent data fabrics

HockeyStack — Agentic workflows and “Odin,” an agent for your analytics

Apollo.io — AI outbound agent and “power-ups” baked into search and insights

Revenue Orchestration

Sales Agents & Plays

Warmly — Pre-built GTM AI Agents: MarketingOps, DemandGen, SDRs

Seam AI — Opinionated agent-driven GTM plays, no GTM engineer required

Advanced ARR Reporting

RevOps reporting

ChartMogul — No native agent, but provides API access to integrate with others

AccountAim — Uses agentic orchestration for RevOps data integration

RevOper — LLM assistant for deal-level support (need to request a demo to see it)

FP&A tools

Subscription Management

What’s Next for this newsletter

This is just the start. Over the coming weeks, I’ll be expanding this into:

A live database of GTM agent capabilities

Ongoing agent market research

Weekly insights on agent news and its GTM implications

If you work in the office of CRO, CMO, or CFO subscribe now to stay ahead of the agent-driven GTM revolution.

Why This Matters

Agent adoption is no longer optional. The winners will be GTM leaders who pick the right agent strategy early — and align their tech stack to execute it.

This newsletter will be your shortcut to understanding where the market is headed — and how to stay ahead.

Great analysis, thank you! What really excites me is how companies at both ends of the market are adopting AI agents for GTM—whether via Agent Workforce, Agentic Orchestration, or hybrids.

Even enterprise go-to-market motions are shifting from signal capture and account research to AI-assisted articulation and narrative creation. It echoes the disk drive industry - classic Christensen at work